Dakota County Homestead Calculator . Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. Please visit the applying for homestead page on the dakota county website. Our dakota county property tax calculator can estimate your property taxes based. after the assessor’s office determines the market value and classification of a property, property. dakota county residents pay an average of $3,271 in property taxes annually. This amount is a bit higher than the median property. you can also apply for homestead in person, by mail, fax or email. The assessor’s office also determines the classification, or use, of each parcel. estimate my dakota county property tax.

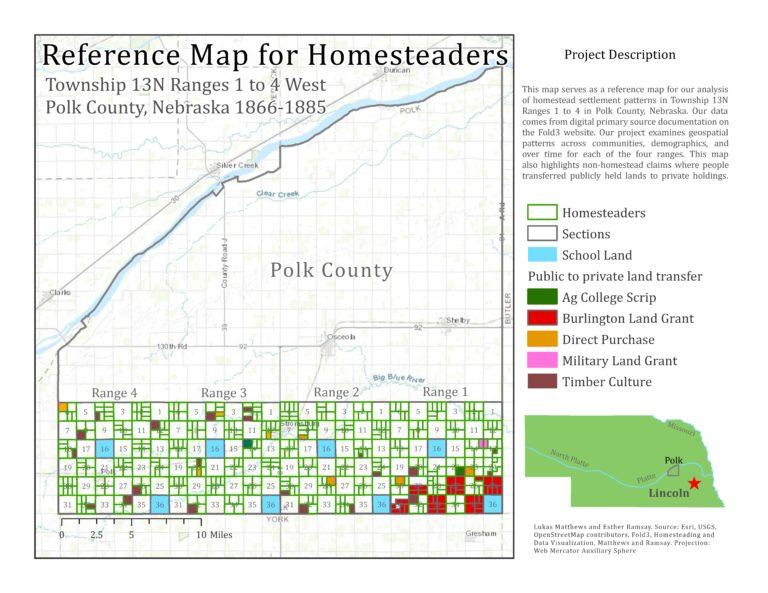

from rebeccawingo.com

estimate my dakota county property tax. after the assessor’s office determines the market value and classification of a property, property. you can also apply for homestead in person, by mail, fax or email. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. This amount is a bit higher than the median property. Our dakota county property tax calculator can estimate your property taxes based. Please visit the applying for homestead page on the dakota county website. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. dakota county residents pay an average of $3,271 in property taxes annually. The assessor’s office also determines the classification, or use, of each parcel.

Spatial Analysis of Homesteaders in Polk County, Nebraska The

Dakota County Homestead Calculator The assessor’s office also determines the classification, or use, of each parcel. This amount is a bit higher than the median property. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. estimate my dakota county property tax. after the assessor’s office determines the market value and classification of a property, property. Please visit the applying for homestead page on the dakota county website. dakota county residents pay an average of $3,271 in property taxes annually. The assessor’s office also determines the classification, or use, of each parcel. you can also apply for homestead in person, by mail, fax or email. Our dakota county property tax calculator can estimate your property taxes based. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400.

From hellohomestead.com

How to start homesteading in North Dakota Hello Homestead Dakota County Homestead Calculator Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. Our dakota county property tax calculator can estimate your property taxes based. dakota county residents pay an average of $3,271 in property taxes annually. estimate my dakota county property tax. for homesteads valued at $76,000 or less,. Dakota County Homestead Calculator.

From www.whereig.com

Dakota County Map, Minnesota Where is Located, Cities, Population Dakota County Homestead Calculator dakota county residents pay an average of $3,271 in property taxes annually. Please visit the applying for homestead page on the dakota county website. This amount is a bit higher than the median property. after the assessor’s office determines the market value and classification of a property, property. The assessor’s office also determines the classification, or use, of. Dakota County Homestead Calculator.

From hellohomestead.com

How to start homesteading in North Dakota Hello Homestead Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. you can also apply for homestead in person, by mail, fax or email. dakota county residents pay an average of $3,271 in property taxes annually. Please visit the applying for homestead page on the dakota county website. Located south of minneapolis, dakota county has property taxes. Dakota County Homestead Calculator.

From www.ndstudies.gov

Section 5 Homesteading 4th Grade North Dakota Studies Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. The assessor’s office also determines the classification, or use, of each parcel. estimate my dakota county property tax. after the assessor’s office determines the market value and classification of a property, property. for homesteads valued at $76,000 or less, the exclusion is 40% of the. Dakota County Homestead Calculator.

From hellohomestead.com

How to start homesteading in South Dakota Hello Homestead Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. This amount is a bit higher than the median property. estimate my dakota county property tax. you can also apply for homestead in person, by mail, fax or email. The assessor’s office also determines the classification, or use, of each parcel. Please visit the applying for. Dakota County Homestead Calculator.

From apkpure.com

Homesteaders Rate Calculator APK für Android herunterladen Dakota County Homestead Calculator after the assessor’s office determines the market value and classification of a property, property. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. estimate my dakota county property tax. dakota county residents pay an average of $3,271 in property taxes annually. The assessor’s office also determines. Dakota County Homestead Calculator.

From www.geocurrents.info

North America Archives GeoCurrents Dakota County Homestead Calculator after the assessor’s office determines the market value and classification of a property, property. This amount is a bit higher than the median property. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. Our dakota county property tax calculator can estimate your property taxes based. estimate my. Dakota County Homestead Calculator.

From www.ndstudies.gov

Section 2 Homestead Act of 1862 8th Grade North Dakota Studies Dakota County Homestead Calculator This amount is a bit higher than the median property. Please visit the applying for homestead page on the dakota county website. The assessor’s office also determines the classification, or use, of each parcel. you can also apply for homestead in person, by mail, fax or email. Our dakota county property tax calculator can estimate your property taxes based.. Dakota County Homestead Calculator.

From www.montgomerycountymd.gov

Homestead Tax Credit Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. The assessor’s office also determines the classification, or use, of each parcel. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. after the assessor’s office determines the market value and classification of a property,. Dakota County Homestead Calculator.

From listen.sdpb.org

Exhibit Highlights South Dakota Homesteaders SDPB Radio Dakota County Homestead Calculator This amount is a bit higher than the median property. estimate my dakota county property tax. after the assessor’s office determines the market value and classification of a property, property. The assessor’s office also determines the classification, or use, of each parcel. dakota county residents pay an average of $3,271 in property taxes annually. Located south of. Dakota County Homestead Calculator.

From offgridgrandpa.com

How To Finance A Homestead In South Dakota ( Top 5 Options ) » Off Grid Dakota County Homestead Calculator Please visit the applying for homestead page on the dakota county website. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. The assessor’s office also determines the classification, or use, of each parcel. dakota county residents pay an average of $3,271 in property taxes annually. you can. Dakota County Homestead Calculator.

From www.progressive-charlestown.com

Progressive Charlestown Introducing the Magic Tax Calculator for the Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. dakota county residents pay an average of $3,271 in property taxes annually. you can also apply for homestead in person, by mail, fax or email. estimate my dakota county property tax. for homesteads valued at $76,000 or less, the exclusion is 40% of the. Dakota County Homestead Calculator.

From dxoiodrih.blob.core.windows.net

Dakota County Property Tax Homestead at Wilson Womack blog Dakota County Homestead Calculator estimate my dakota county property tax. The assessor’s office also determines the classification, or use, of each parcel. you can also apply for homestead in person, by mail, fax or email. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. dakota county residents pay. Dakota County Homestead Calculator.

From appadvice.com

Dakota Homestead by MyPad3D Dakota County Homestead Calculator after the assessor’s office determines the market value and classification of a property, property. dakota county residents pay an average of $3,271 in property taxes annually. This amount is a bit higher than the median property. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. you. Dakota County Homestead Calculator.

From dxoswipaw.blob.core.windows.net

Dakota County Online Property at Gustavo White blog Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. dakota county residents pay an average of $3,271 in property taxes annually. The assessor’s office also determines the classification, or use, of each parcel. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. Located. Dakota County Homestead Calculator.

From rebeccawingo.com

Spatial Analysis of Homesteaders in Polk County, Nebraska The Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. for homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The assessor’s office also determines the classification, or use, of each parcel. Please visit the applying for homestead page on the dakota county website. after. Dakota County Homestead Calculator.

From printableformsfree.com

Free Printable Ez Homestead Forms Printable Forms Free Online Dakota County Homestead Calculator Our dakota county property tax calculator can estimate your property taxes based. Please visit the applying for homestead page on the dakota county website. estimate my dakota county property tax. after the assessor’s office determines the market value and classification of a property, property. dakota county residents pay an average of $3,271 in property taxes annually. . Dakota County Homestead Calculator.

From dxoiodrih.blob.core.windows.net

Dakota County Property Tax Homestead at Wilson Womack blog Dakota County Homestead Calculator you can also apply for homestead in person, by mail, fax or email. Located south of minneapolis, dakota county has property taxes that are somewhat lower than those in the other counties of. The assessor’s office also determines the classification, or use, of each parcel. for homesteads valued at $76,000 or less, the exclusion is 40% of the. Dakota County Homestead Calculator.